What's the best option for a chart to illustrate price elasticity? Two Axis with a line? : r/PowerBI

Option Skew — Part 5: Alternative Stochastic Processes and Constant Elasticity of Variance (CEV) | by Roi Polanitzer | Medium

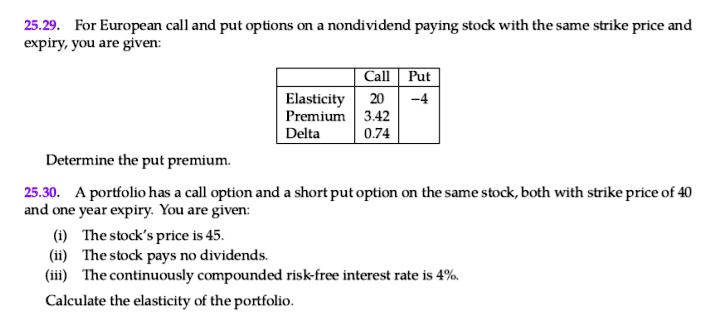

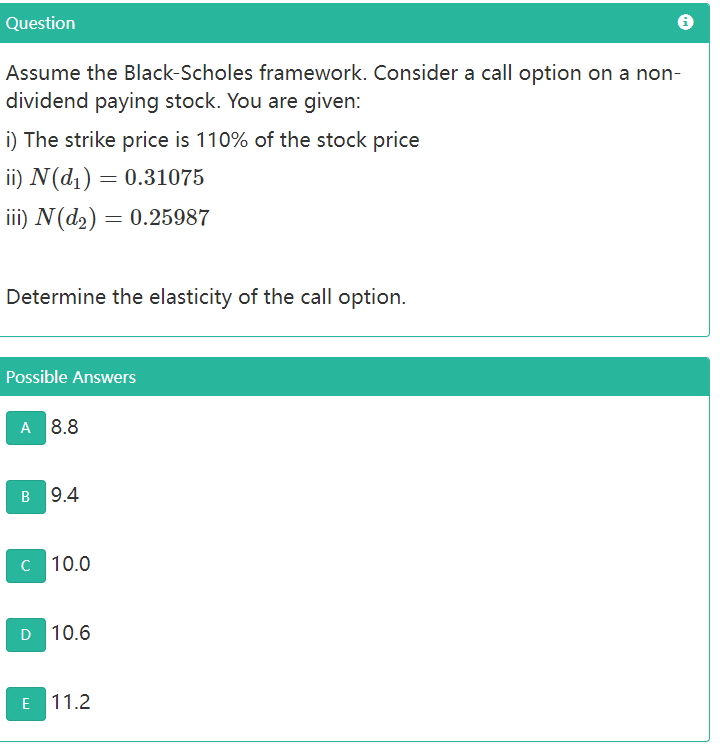

SOLVED: Investment Mathematics 25.29. For European call and put options on a non-dividend paying stock with the same strike price and expiry, you are given: Call Put Elasticity 20 4 Premium 3.42

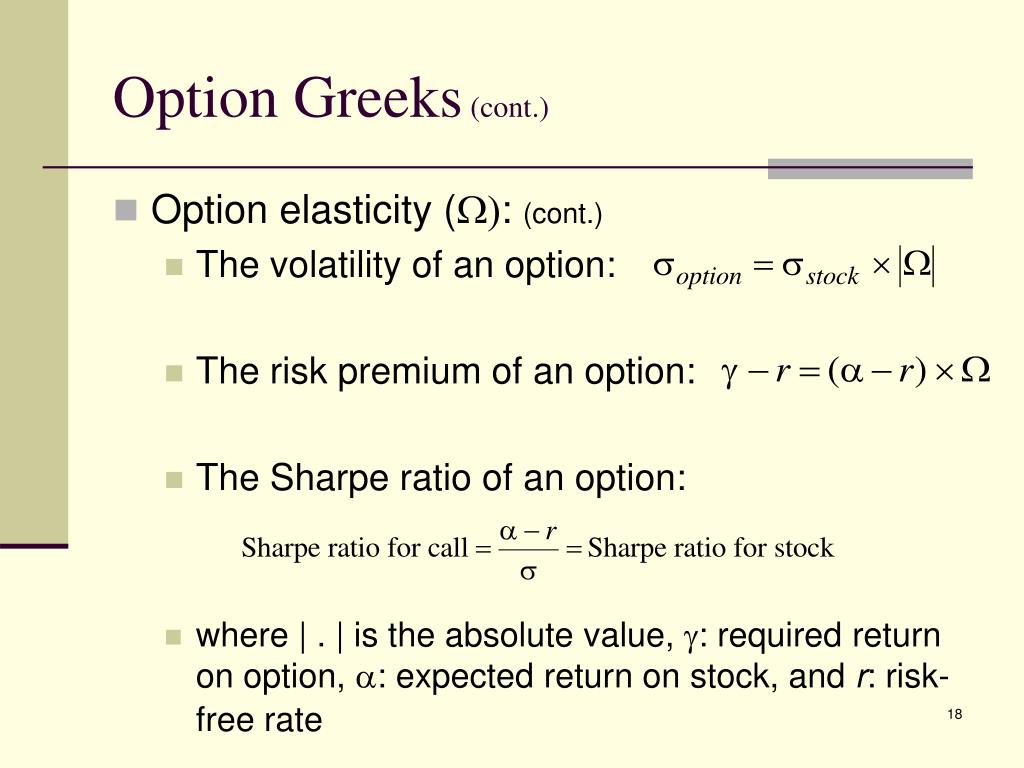

1 Options Option Basics Option strategies Put-call parity Binomial option pricing Black-Scholes Model. - ppt download

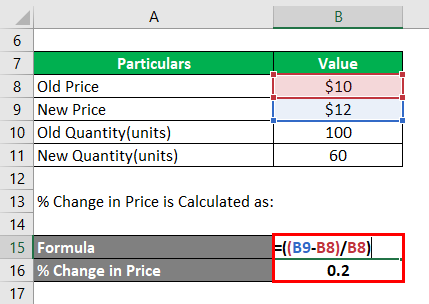

Calculate the elasticity of a call option with a premium of $6.50 and a strike price of $61. The call has a - Brainly.com

Semi-elasticity of unemployment rate with respect to the outside Option-US | Download Scientific Diagram

![PDF] The Constant Elasticity of Variance Model ∗ | Semantic Scholar PDF] The Constant Elasticity of Variance Model ∗ | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/60179494f6c8288e004308b15aad83fd9cc72ea7/7-Figure1-1.png)

![PDF] Option pricing with constant elasticity of variance (CEV) model | Semantic Scholar PDF] Option pricing with constant elasticity of variance (CEV) model | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/8f8ce3fbade3190c56eded40b5eacbc4e48b86cb/11-Figure1-1.png)

:max_bytes(150000):strip_icc()/priceelasticity-89c3478d270c4d19b117be316fb98208.png)